Void an Invoice

It’s best to void an invoice on the same day it was entered to keep the day’s deposit amount correct. If a correction needs to be made at a later date, instead of voiding the incorrect invoice, a reversing invoice should be created to zero out the charges.

NOTE: Voided invoice amounts will show on some of the reports or pages but will not be added into report totals.

Follow the steps below to void an invoice or to check the history to see if an invoice has been voided.

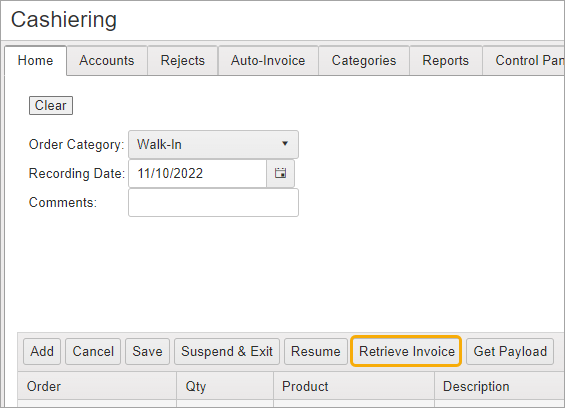

Navigate to Cashiering > Home.

On the Cashiering Home screen, click the Retrieve Invoice button on the grid. See Retrieve Invoice for more information.

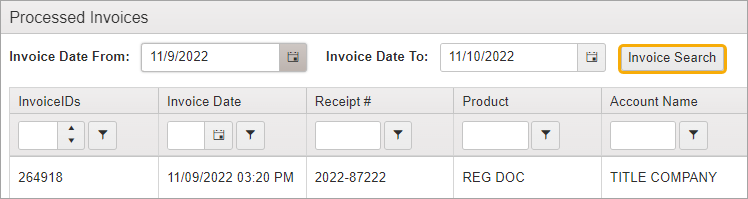

Enter the date range for the invoice to be voided.

Click Invoice Search.

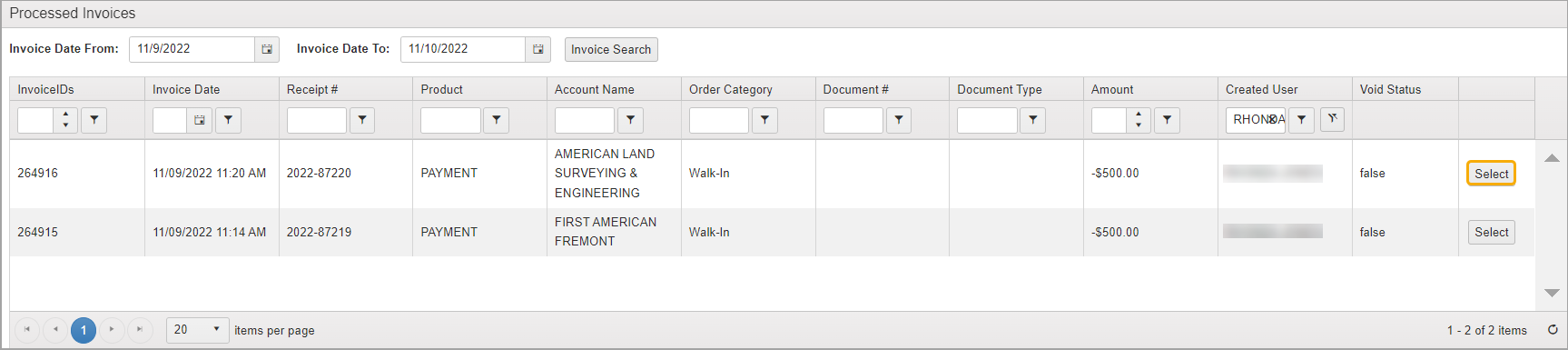

Use other filters as necessary to locate desired invoice.

Click Select.

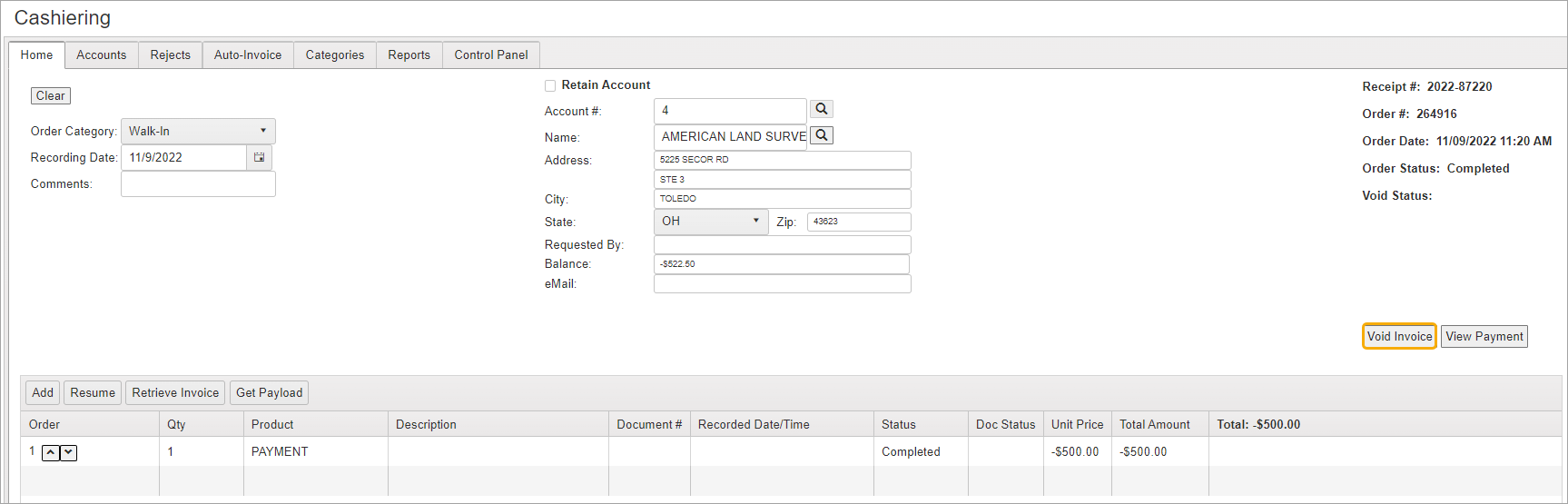

Once the invoice is displayed, the Void Invoice button will be available.

Click the Void Invoice button above the grid.

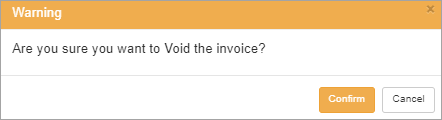

Confirm the void prompt to void the invoice.

A success message appears.

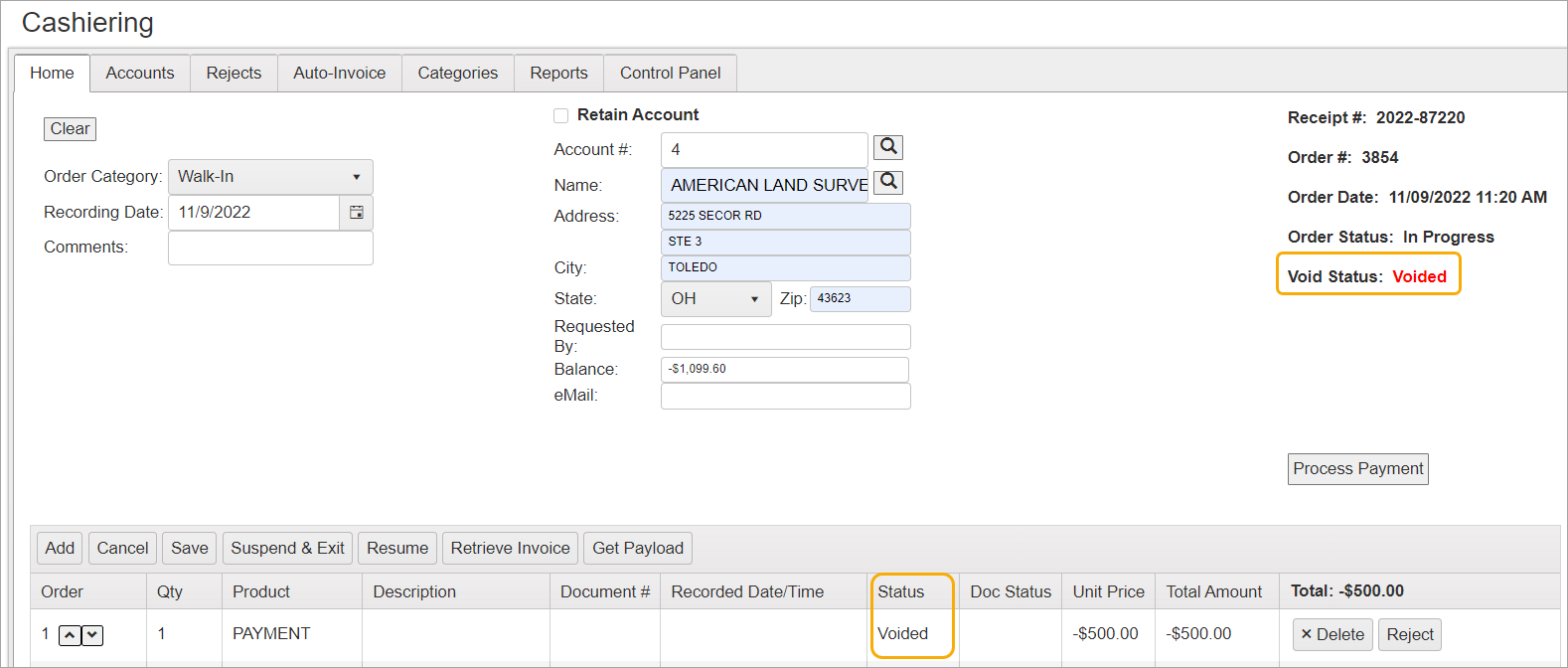

On the Cashiering screen, the Void status is shown in the grid and also in the information block on the right.

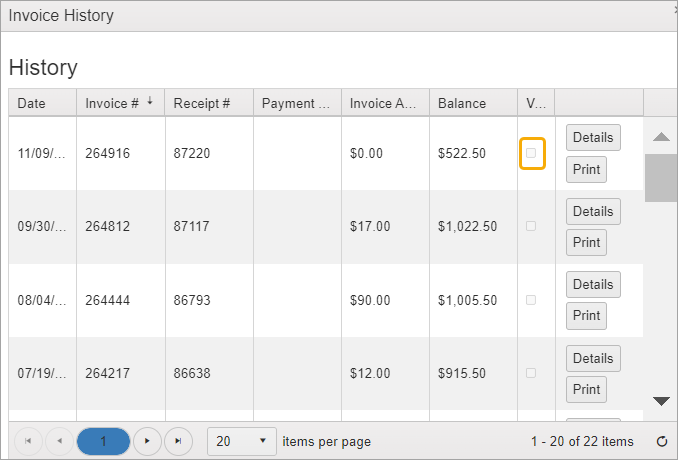

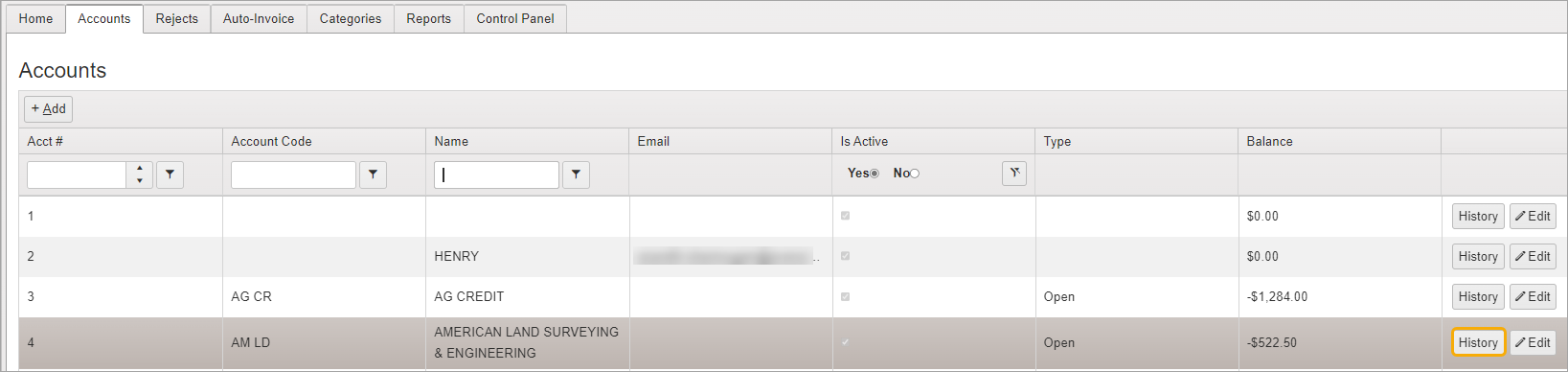

Navigate to Cashiering > Accounts tab.

On the Accounts screen, use the Acct #, Account Code, or Name filters to locate the account.

Click History in the account row.

A checked box in the Void column will indicate that the invoice has been voided.